We love breaking news - whether good or bad news. We take it all in, refine it and sieve out the good from the bad; then convert them into profits 🙂

- UK Global Investors

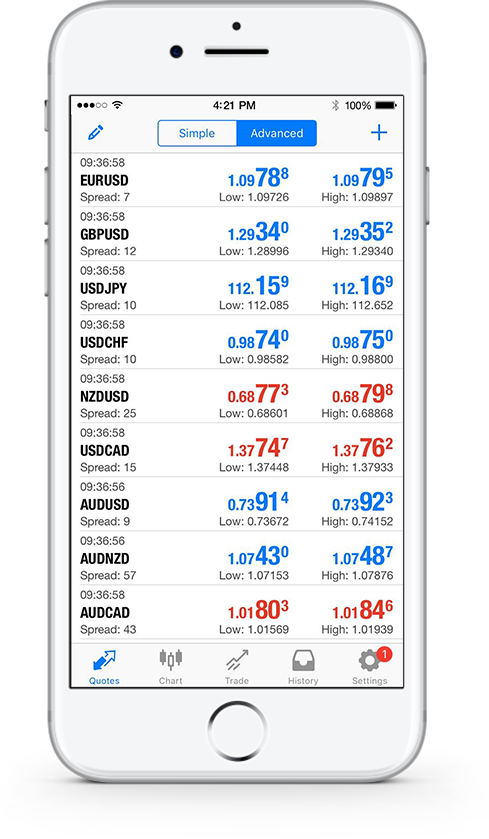

Enjoy instant access to breaking news, market announcements and news articles on everything from forex, stocks, indices, commodities, companies and global economies.

News streams straight from over 50 providers, including central banks, credit rating agencies, financial exchanges, plus major news agencies Nasdaq, MarketWatch, Yahoo Financials & CNBC.

Gold, Silver Continue to Make Strong Gains, Gold Reaches Fresh Record High; S&P 500 Index Trades Above 7,000 Off Hours; Trump Shrugs Off Weak US Dollar; Australian Inflation Rises Unexpectedly; WTI Crude Oil Nears 4-Month High; Markets Await Fed, Bank of Canada Policy Meetings

Gold, Silver Continue to Make Strong Gains, Trade at Fresh Record Highs; S&P 500 Index Threatens Record High; Canada Backs Off China Deal; India/EU Agree Trade Deal; Trump Threatens 25% South Korea Tariff

Bitcoin’s decline, erasing billions in market value, underscores the cryptocurrency's vulnerability to macroeconomic and geopolitical pressures in early 2026.

Gold, Silver Continue to Make Strong Gains, Trade at Fresh Record Highs; Japanese Yen Gains on BoJ Intervention Fears, Coordination With USA; US Dollar Continues to Drop; Trum Threatens 100% Tariff on Canada on Proposed China Trade Deal

Earlier this month, a US military operation captured Venezuelan leader Nicolas Maduro and transported him to New York to face trial for narco-terrorism conspiracy. This was followed by the massive protests in Iran, which were bloodily suppressed by the Iranian regime. President Trump strongly hinted at a military response against Tehran and fears of war in the Middle East increased dramatically. Trump now appears to have backed off, saying it is because Iran agreed not to execute hundreds of protestors. Oil prices, which had climbed to multi-week highs during the unrest, eased after Trump moved away from military action.

AUD/USD, AUD/JPY Power Higher as Australian Unemployment Makes Surprise Fall; Trump Calms Markets by Renouncing Force on Greenland, Downplays Potential Iran War, Takes Tariffs Off Table - Stocks Recover; Gold Makes New Record Then Retreats; Japanese Bond Yields Hit Record Highs; US Final GDP & PCE Price Index Data Due Today

Gold and Silver Rise to Records on Greenland Tariff War / Iran War Fears; Trump Projects Greenland Acquisition, Heads to Davos for EU Meetings; Stock Markets Trading Lower, S&P 500 Index Stabilizes at 1-Month Low

Gold and Silver Rise to Records on Greenland Tariff War / Iran War Fears; Trump Imposes New Tariff on Several European Nations on Greenland, Question of EU Pushback; Stock Markets Trading Lower, S&P 500 Index Nears 1-Month Low; Bitcoin Falling

Trump Claims Killings and Executions in Iran Seem to Have Halted, Crude Oil, Energies, & Silver Fall Sharply; Japanese Yen Regains Some Strength

Iran Blackout Continues, Reports of Massacres Emerging; Trump Seen Likely to Hit Iran Within Week, WTI Crude Oil Hits 2-Month High; US CPI Unchanged at 2.7%; Gold Touches $4,634, Silver $91.57; S&P 500 Index Briefly Touches All-Time High Near 7,000; Japanese Yen Reaches 18-Month Low on Snap Election Rumour

The European Central Bank recently released its monetary policy meeting minutes, showing that the bank’s policymakers supported the decision to continue with an accommodative monetary policy stance until March 2022.

Bank of England Governor Andrew Bailey said recently that the latest surge in the number of COVID-19 infections has put the British economy in shambles, delaying the country’s recovery.

According to recently released electoral data, the Democratic Party will likely grab the two Georgia Senate seats that were in dispute, giving the party a trifecta for the first time since 2009.

According to Germany's Federal Statistical Office, retail sales rose by 5.6% (annually) in November, higher than expectations of 3.9% but lower than the previous month's 8.6% rise.

The British House of Commons approved the trade agreement with the European Union yesterday in a 521-73 vote, ending the Brexit saga just before the deadline.

The US House of Representatives decided to back President Trump’s proposal to give additional stimulus payments to Americans in need, which has been a recent point of contention between both parties.

The end of autumn 2020 will forever go down in the story of the Forex market.

The Bank of Japan recently released its monetary policy meeting minutes, in which policymakers discussed forms of making their monetary stimulus measures more sustainable.

The US Federal Reserve recently announced its decision to leave the cash rates unchanged, remaining in line with analysts' expectations.

The United Kingdom’s Office for National Statistics recently reported the country’s unemployment rate, which stands at 4.9 percent for the third quarter, and lower than expectations of 5.1 percent.

The Euro has finally made a decision to break out. However, the one problem is that it did it the day before a FOMC press conference. Still a bullish look though.

The CAD/CHF pair isn’t one I focus on a lot, but it could be a good “back door” way of playing the CHF strength, or central bank intervention later.

The US dollar continues to see a lot of selling on Tuesday in the overall Forex markets, but in the USD/JPY pair, its had an entirely different foe over the last couple of sessions.

The US dollar has fallen again against the Mexican peso, breaking below the hammer from the previous session, a sign of weakness I often trade. This is a market that pays you to stay short, in the “carry trade.”

The USD/BRL closed yesterday around the 5.1847 ratio after facing another round of strong selling, and traders should be braced another dose of volatility on today’s opening.

Quite frankly, I believe that the German stock market is one that should have a good 2026, and I plan on being there, as the German government has been throwing money all over the place.

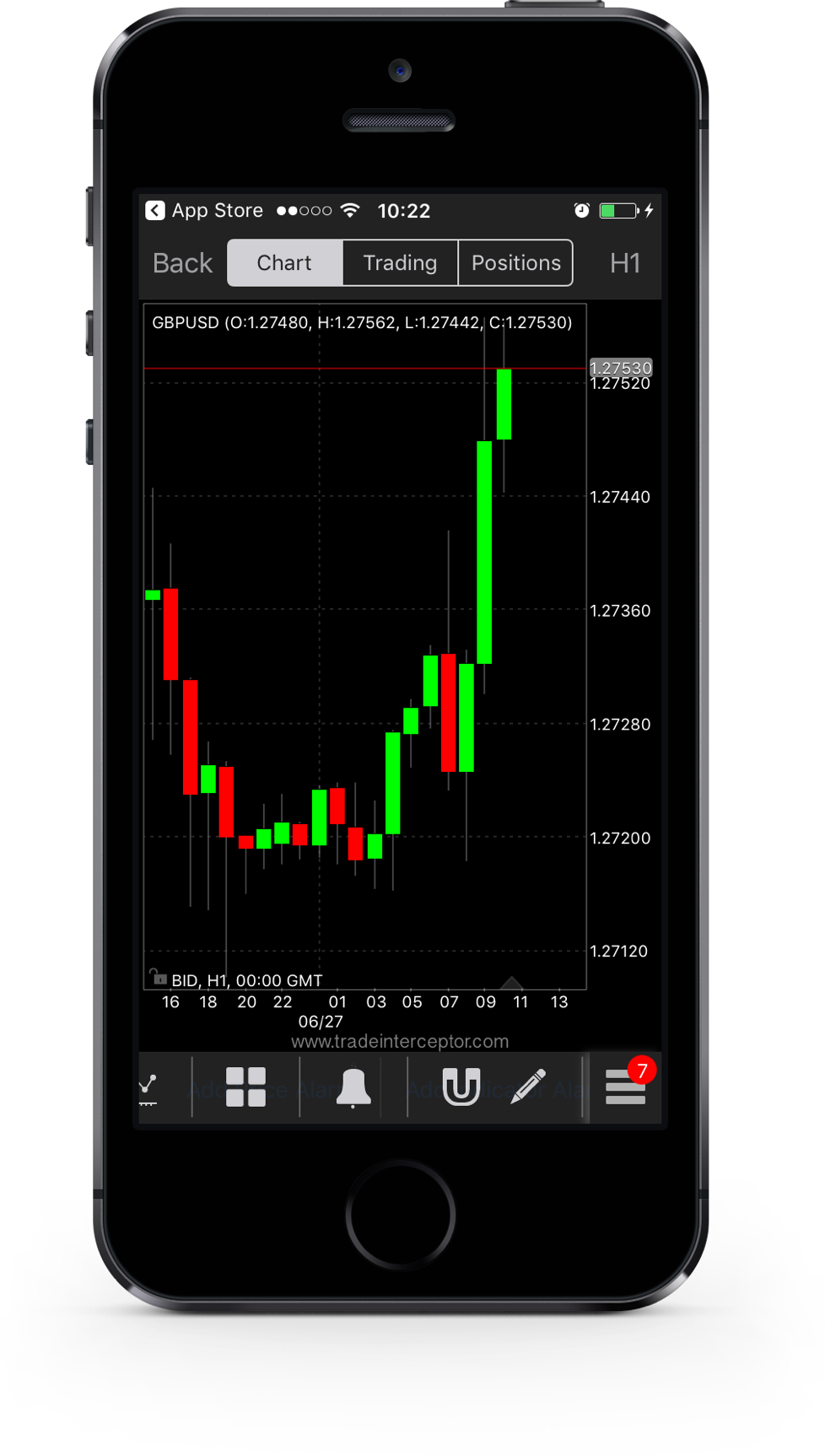

British pound rocketed higher on Tuesday as we continue to see the US dollar weaken at the moment.

The USD/SGD is near the 1.26115 ratio as of this writing in extremely fast markets, this as a storm of USD selling has struck Forex and people try to be heard regarding their opinions on why it is happening.

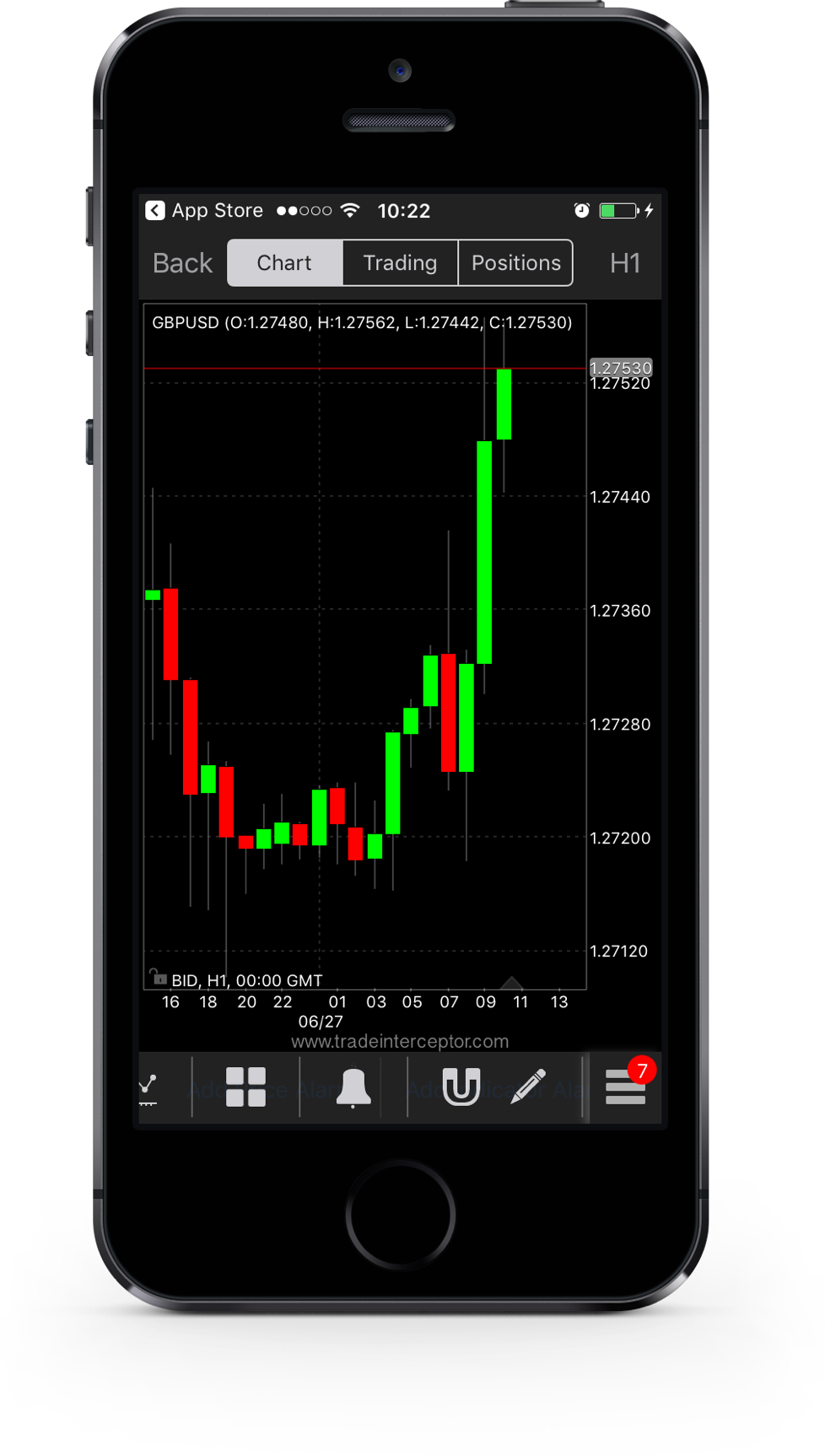

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

The GBP/USD exchange rate continued its strong rally, reaching its highest level since 2021. It jumped to a high of 1.3780, continuing a trend that started in November when it bottomed at 1.3030.

MARKET DATA:

UK Global Investors (UKGI) provides links to selected sources of market updates. Clients searching for how or the best way to invest use those sources through UKGI’s website. The sources are part of its free service for all market traders. UKGI sometimes agrees or differs with the updates as do other traders. Some of the updates are the views of the authors, writers and editors. The main aim is to provide balanced views across different markets.

We expect clients and traders to be thoughtful before acting on any market info. Be careful to process the market data received from our website before using such to trade. Sometimes market data and news items shown on this website come up after some delay. Our web portal receives rates and prices as-is. The web data may sometimes differ from the rates shown at the central data bank. This means the delayed market rates may not be suitable for use at that time. Thus we will not accept any blame for losses as a result of the use of delayed data.

UKGI helps clients and traders in need of safe ways to invest for the best. Contact the broker or trading firm for more info before you deposit funds. This web portal provides free articles, news items, research and related info. Clients should use them as-is. Traders should know how the sources help them as the best way to invest. UKGI takes neither credit nor blame from the use of its trading data. This applies to any profits or losses earned.

OUR SERVICE:

UKGI runs a free forex investing service by trading in the forex market. We earn profits on the capital and get paid by top tier 1 liquidity providers. Currency or forex trading comes with large rewards. The same applies to risks. Self traders must know how the rewards and risks affect their capital. They must accept both to earn from forex or the broad financial markets. Trading results usually vary over time. Factors for this include price feeds, demand and supply, breaking news, and others. We still apply them as tools to create the best way to invest.

Using margin to trade the markets raises the risk of profits or losses. Margin is funds borrowed from a broker. This adds to the account’s equity or balance for trading. It may thus lead to high risk trading. Take all the right steps to learn the correct info about market products. Know your financial goals as well as your risk level. Get expert advice on the best way to invest before making a deposit.

Copyright © 2026 | UK Global Investors